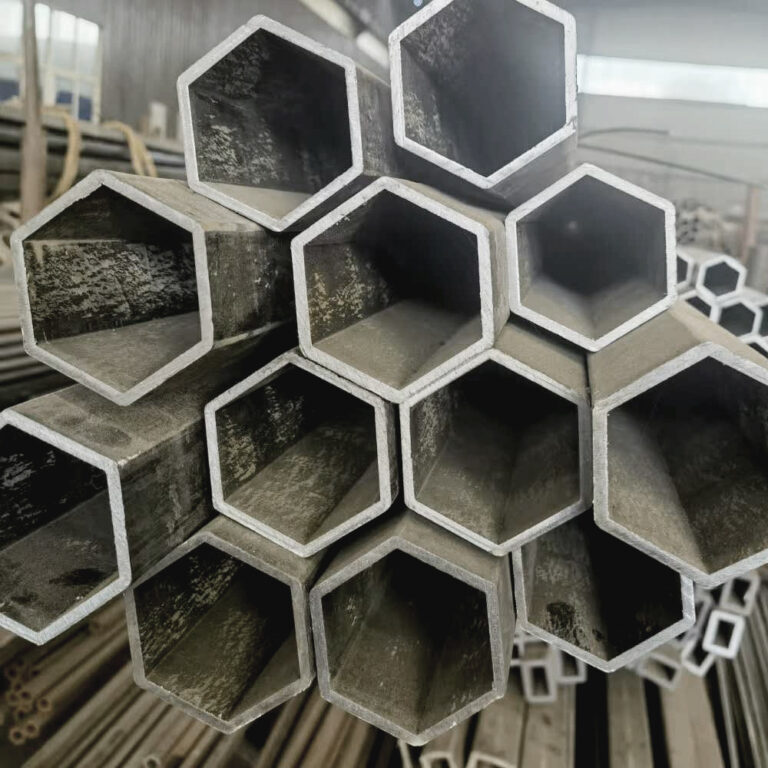

Seamless Steel Pipe Supplier from China

Impact of the U.S. “Reciprocal Tariff” Policy

The US “reciprocal tariff” policy has brought many impacts:

Impact on the United States itself:

Economic level:

Inflationary pressure increases: The increase in tariffs increases the cost of imported goods, which will be transmitted to the consumer end, leading to rising prices. Consumer goods such as mobile phones, cars, and daily necessities are expected to have high price increases, which will further aggravate the inflation problem in the United States and affect consumers’ purchasing power and living standards. Import-related items account for about 6% of core PCE (personal consumption expenditure deflator) inflation, indicating that changes in tariffs on imported goods have a certain impact on US inflation.

Difficulties in industrial structure adjustment: Although the United States has tried to promote the return of manufacturing through tariff policies, the actual effect may not be good. On the one hand, the labor cost in the United States is high, 8-10 times that of emerging economies, which makes the production cost of manufacturing in the United States higher, and companies lack sufficient motivation to move the production links back to the United States. On the other hand, tariff policies may lead to the breakage and instability of the industrial chain and supply chain, making the development of the manufacturing industry face greater challenges. For example, the steel tariff policy has increased some jobs in the steel industry in the short term, but the downstream manufacturing industry has lost a large number of jobs as a result.

The trade deficit is difficult to improve: The implementation of the “reciprocal tariff” policy by the United States may trigger countermeasures from other countries, which will lead to restrictions on US exports and make it difficult to effectively improve the trade deficit. In 2024, the US trade deficit reached 918.4 billion US dollars. Although the tariff policy increased fiscal revenue in the short term, it did not fundamentally solve the trade deficit problem.

Financial market volatility: The uncertainty of tariff policies and trade tensions will affect investor confidence and lead to fluctuations in financial markets. The US stock market may be hit, and investors’ concerns about the economic outlook will make capital flows more cautious, which will have an adverse impact on the stability of the US financial market.

Employment: The impact of tariff policies on employment is complex. On the one hand, some industries may increase some jobs due to tariff protection, such as the steel industry; but on the other hand, downstream manufacturing and related industries may reduce jobs due to rising costs and export restrictions. Overall, the net impact of tariff policies on employment may not be optimistic.

Impact on the global economy:

Reshaping of the trade pattern: The US “reciprocal tariff” policy has broken the original trade balance and led to changes in the global trade pattern. Some countries may reduce exports to the United States and instead strengthen trade cooperation with other countries, which will promote the readjustment of global trade flows. For example, China may strengthen trade with the EU, ASEAN and other regions to reduce its dependence on the US market.

Supply chain obstruction: Tariff policies have disrupted the global supply chain, and companies need to reassess and adjust their supply chain layout. Some companies may transfer their production bases from the United States or countries that are more affected by tariffs to other countries to reduce costs and avoid tariff risks. This will lead to the reconstruction and optimization of the global supply chain, and the synergy of the industrial chain may be affected to a certain extent.

Economic growth slowdown: As the world’s largest economy, changes in the United States’ trade policies have an important impact on global economic growth. The trade tensions caused by the “reciprocal tariff” policy will reduce the activity of global trade and reduce the flow of international trade, thereby suppressing global economic growth. According to relevant research, “reciprocal tariffs” and related countries’ countermeasures against the United States may slow down the global real GDP growth rate.

Impact on other countries:

Export restrictions: For countries that have large trade relations with the United States, such as China, the European Union, Japan, South Korea, etc., the US “reciprocal tariff” policy will directly lead to restrictions on their exports to the United States, and export companies will face problems such as reduced orders and declining profits. The relevant industries in these countries may be impacted and need to find new markets and development opportunities.

Intensified industrial competition: In the case of export restrictions in the US market, companies in other countries may turn their attention to the domestic market or other countries’ markets, which will intensify competition in the domestic market and other countries’ markets. Companies in various countries need to improve their competitiveness to cope with a more intense market competition environment.

Promote industrial upgrading: In the face of the US “reciprocal tariff” policy, companies in other countries may increase R&D investment, improve product quality and technical level, and promote industrial upgrading. This will help improve the industrial competitiveness of these countries and reduce their dependence on the US market.