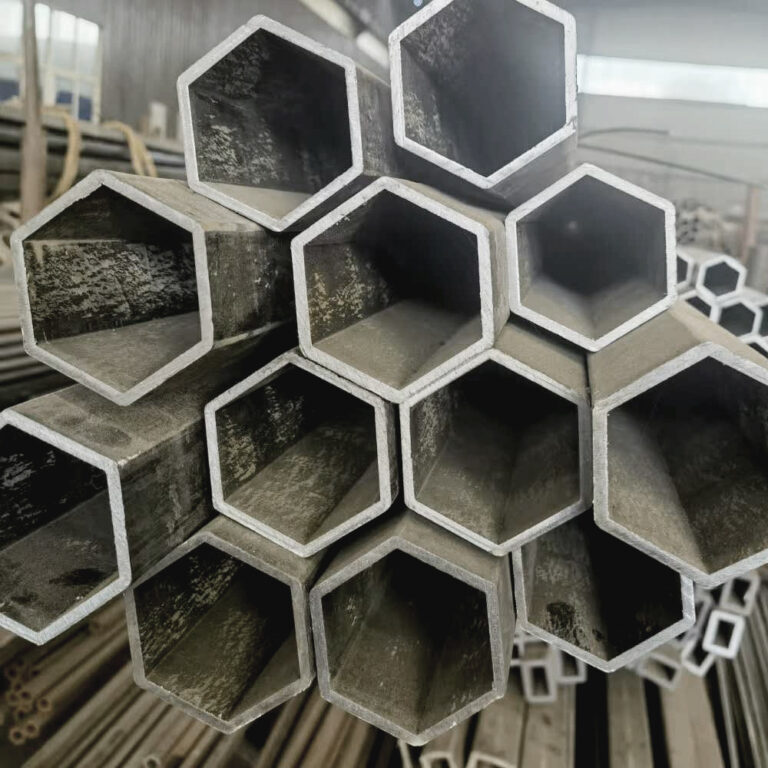

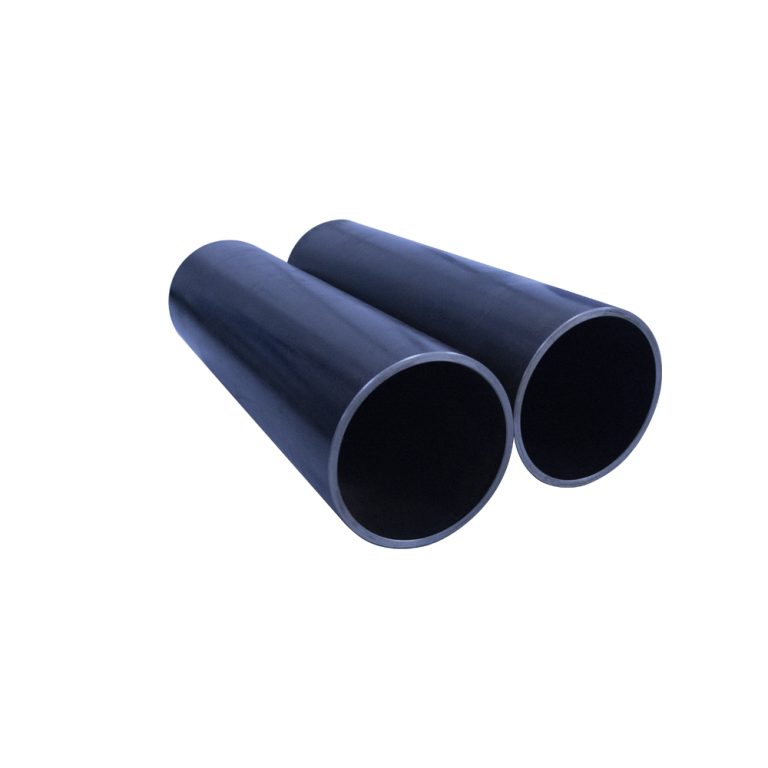

Seamless Steel Pipe Supplier from China

As external risks spread, steel demand is expected to weaken

Recently, the instability factors in the global economic environment have increased significantly, and the spread of external risks is gradually affecting the steel market, causing its demand to show a weakening expectation.

From the perspective of international policy, the adjustment of a series of tariff policies in the United States is the first to be affected. On April 2, local time, US President Trump signed an executive order on the so-called “reciprocal tariff”, announcing that the United States would impose a 10% “minimum benchmark tariff” on trading partners and impose higher tariffs on certain trading partners. The introduction of this policy has had a huge impact on the global trade order. Although the direct export volume of domestic steel to the United States accounts for a small proportion, the transmission mechanism of restricted exports of downstream products such as home appliances and automobiles indirectly has a negative impact on steel demand, especially plate demand. Previously, when the tariff policy was not implemented, there was a phenomenon of rushing to export in the downstream industry. Now that the tariff has been implemented, the subsequent export situation is not optimistic, and there are obvious signs of weakening demand.

Under the current supply and demand pattern of the steel market, the supply side maintains a high level. Taking the data for the week of April 3 as an example, the weekly output of rebar under the same caliber was 2.2865 million tons, an increase of 160,200 tons over the same period last year, an increase of 7.53%, and the output recovered rapidly due to the good profit per ton of steel. Among the 247 sample steel mills of Steel Union, the proportion of profitable steel mills was 55.41%, and the corresponding 77 independent arc furnace steel mills of building materials accounted for only 11.69% of losses. The enthusiasm of enterprises for production is high, and it is expected that the subsequent supply will remain high. In terms of plates, although domestic demand has maintained a certain degree of resilience for the time being, foreign demand faces greater risks, and the risk of export inspections is relatively high. The hot-rolled coil factory warehouse has begun to accumulate warehouses, and there is a trend of flattening or even slightly rising in the future. If the cold series output returns to hot-rolled coils, the accumulation speed will be further accelerated. The performance on the demand side is not satisfactory. From the perspective of construction steel, although demand has shown a seasonal recovery trend, the recovery is weak. As of the week of April 3, the weekly apparent demand for rebar was 2.4969 million tons. Although it has rebounded from a low level, it is still at a low level in recent years, down 262,700 tons year-on-year. The average daily trading volume of construction steel by major traders nationwide in March was 107,700 tons, an increase of 10.45% from February, which is in line with seasonal characteristics, but significantly lower than the same period last year, with a year-on-year decline of 11.54%, the lowest in recent years. The fundamentals of the real estate industry are still in the process of repair, and it is difficult to bring significant increases in steel demand in the short term; although infrastructure investment is highly expected by the market, the recovery is limited due to the lack of large-scale stimulus policies in China, resulting in insufficient demand for rebar in the peak season.

The overall demand for plate is better than that for construction steel. The demand for steel in the domestic manufacturing industry has shown a certain resilience, and exports have also remained at a relatively high level in the early stage. However, the market is worried about the impact of overseas tariffs on steel exports after they are implemented in April. Once the export of plate products is blocked, the output will be under pressure to decline, which will easily lead to steel mills reducing production, thereby dragging down the demand for raw materials. The negative feedback logic will be staged again, and steel prices will also be under pressure to decline. From the inventory situation, although the overall steel inventory continues to be reduced, especially the construction steel inventory is significantly lower than the same period last year, the speed of steel inventory reduction has begun to slow down as steel mills continue to resume production. This also reflects from the side that the demand side is insufficient and it is difficult to quickly digest the continuously increasing supply. At the macro level, the intensification of external risks means that the expectation of domestic policy adjustments has increased. In order to cope with external risks, subsequent domestic policies are expected to be implemented faster and new measures will be introduced. The market has expectations for stimulus policies such as the central bank’s reserve requirement ratio cut and interest rate cut. If the policy can be effectively implemented, it may boost domestic demand to a certain extent and alleviate the pressure of weakening steel demand. However, before the policy is actually implemented and has a significant effect, the steel market will still face the challenges brought by the increase in uncertainty on the demand side. In general, against the background of increasing uncertainty in global trade policies and the recovery of domestic demand being less than expected, the expectation of weakening steel demand is gradually increasing.